Finding a good renter is critically important to any homeowner, especially post-pandemic when the economy is still picking up and most people are recovering from income loss. A rental property is an investment after all, so needing to replace bad renters and potentially exposing yourself to eviction risks can cost you big time.

It’s crucial to select high-quality renters from the start. Good renters do more than just provide you with a stable rental income; they also take good care of your property, helping you save on maintenance costs. To ensure your property investment is on the right track, here are five ways to qualify a good renter post-pandemic.

Set Clear Applicant Criteria

Before qualifying applicants, you need to set solid, predetermined criteria that your renter should meet. These criteria should include the applicant’s credit score, annual income, employment history, and previous rental history.

While you may have your personal preferences, the Fair Housing Act prohibits you from discriminating against any of the protected classes. This means you can’t reject a renter based on their race or color, national origin, religion, gender, familial status, or disability. Approval of renter applications must be based on credit qualifications and income.

Take Credit and Background Checks Seriously

A credit check is critical in determining a prospective renter’s financial capability. It gives you information on their credit history that helps you assess if you can rely on them to make prompt rent payments. A background check will also give you an idea how a potential renter responded to a financial setback like the pandemic. Use the tips below when conducting credit and background checks.

Verify Income

Call the employer of your potential renter. Verify if the company role and salary stated on their rental application are accurate. The renter’s income should be at least three times the rent amount. Suppose your rent is $2,500 per month, multiply that by three and the result of $7,500 should be your prospective renter’s gross monthly income.

Check Credit Report and Credit Score

A credit report shows detailed information of a person’s credit history, which is used to calculate an individual’s credit score — a number that represents their creditworthiness. A credit score of 740 or above is considered very good, while scores higher than 800 are considered excellent. You also need to check the income-to-debt ratio (DTI) found on the credit report. This will give you an overview of the amount of debt compared to the overall income. An ideal DTI is anywhere between 36% and 43%. These details can help you decide if a potential renter is a good fit or a risk to your rental business.

Look at Rental History

Verify with their previous landlords if your potential renter made timely payments and took care of the property well. If the renter was financially affected by the pandemic, ask if they continued to pay rent even when they experienced income loss, or if they made payment arrangements to settle any back rent. By knowing these details, you can weed out the bad renters from those who have been unwitting victims of the economic crisis caused by the pandemic.

Create a Thorough Application Process

When qualifying renters, you must use a thorough and secure rental application process that lawfully allows you to collect their personal and professional information. A secure rental application ensures all the collected data are safely stored online to avoid breaches or loss of sensitive information. Hiring an expert in screening tenants is encouraged to remove potential risks, such as asking discriminatory questions and experiencing data breach that could prompt a fair housing complaint.

You can use any type of rental application template, draft your own, or better yet, opt for an online application from a company offering renter screening. Whatever you use, be sure to include these information below.

Get Personal and Employment Information

This will include, but is not limited to, their full name, Social Security Number, contact information, residential address, and driver’s license. Ask them to provide information such as the name and address of the company they work for, name and contact information of their direct supervisor, and their annual income. It’s also important that they provide proof of income such as pay stubs and tax returns.

Check Personal History

This is the part where you can get information relating to their rental goals and needs, by asking questions like:

- Where did they previously reside and what was their reason for moving to a new property?

- What challenges did they encounter with their previous landlord?

- Did they have any history of bankruptcy or eviction, or have they broken a lease agreement?

- Do they have vices such as smoking?

- Will they be bringing any pets?

- How long do they plan on renting the property?

Nurture Good Tenant-Landlord Relationship

Becoming a good rental owner is more than just filling in your vacancy. It should also be about how to keep your renters. This is why it’s important to nurture your relationship with them.

Treat your renters well

Treating your renters well will make them want to stay longer. Speak to them with respect, send them holiday greetings, and be cordial in your interactions with them.

Keep communication open

From the get-go, establish your openness for any feedback or concerns. You want your renters to be comfortable communicating their needs. This will help them live easily and comfortably in your property. Plus, they can give you insights on how you can better manage your property based on their feedback.

Respond to requests on time

Maintenance requests are inevitable in a rental property. It’s important to state on your lease agreement the time it takes for you to address such requests. This will help you respond promptly, aware of how long the expected turn-around time is.

Seek Professional Help

Finding great renters is a complex process. By seeking professional help, you can avoid hits and misses in qualifying applicants and make the selection process a lot easier and faster. Depend on quality systems that are already working. Property management companies like Poplar Homes have the technology and experience to handle the whole rigorous process for you.

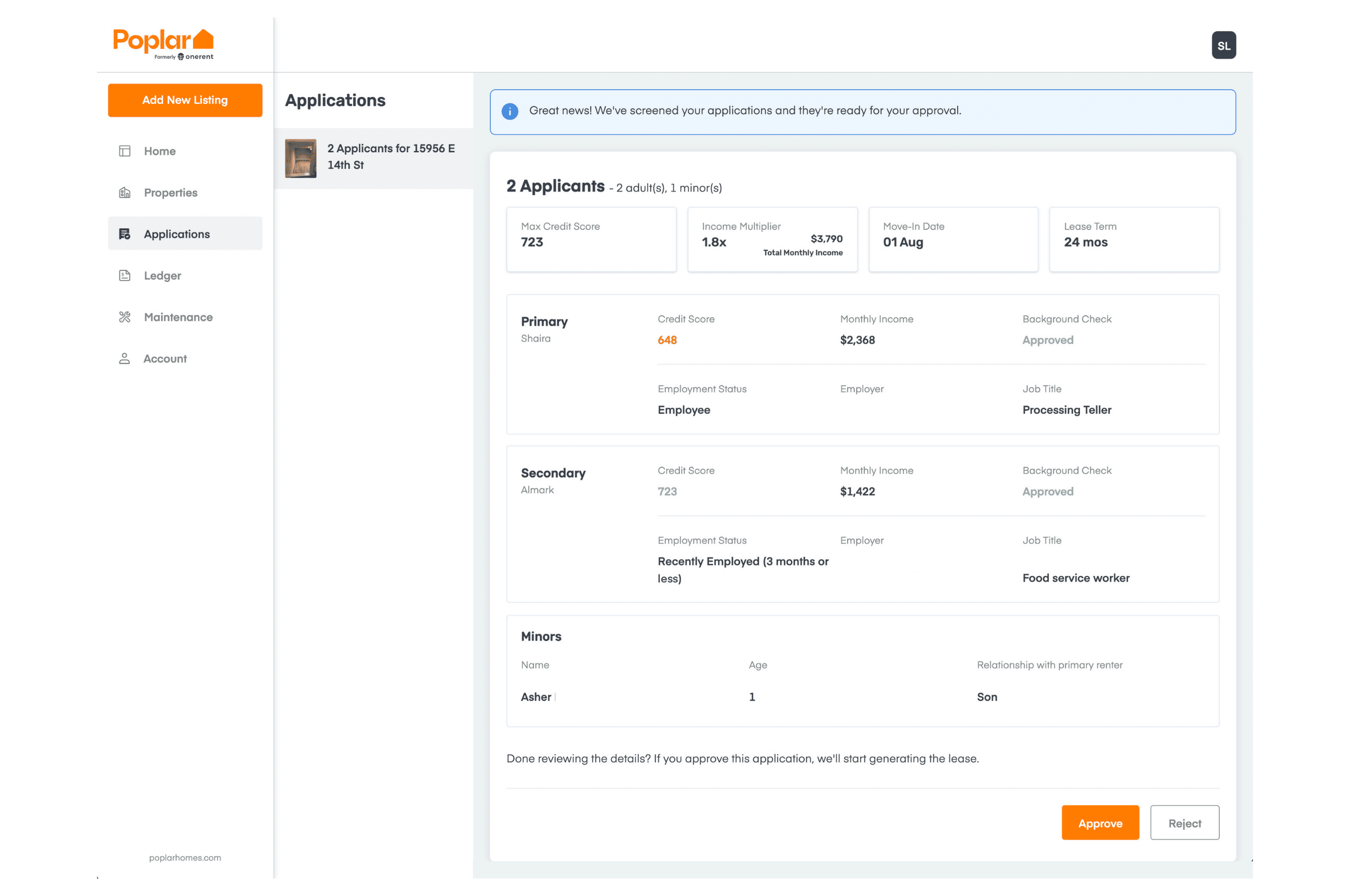

Our online application process makes it fast and convenient for prospective renters to apply to your listing. They can even get help from our chatbot, ACE, in scheduling on-demand home tours. Personal details and employment and background information are carefully reviewed to ensure you get quality applicants. Our online application process makes it fast and convenient for prospective renters to apply to your listing. They can even get help from our chatbot, ACE, in scheduling on-demand home tours. Personal details and employment and background information are carefully reviewed to ensure you get only the most qualified residents.

Outsourcing renter screening to a tech-enabled company like Poplar Homes not only saves you time, but also gives you peace of mind knowing that every application is carefully vetted to find you qualified renters. Check out how our chatbot, ACE helps property owners like you in tenant screening, lease agreements, and more. If you prefer human interaction, our Leasing Team is always available to attend to your concerns.

Conclusion

The renter screening process is one of the most important steps in renting that can help protect your property investment. By having a smooth and reliable screening process, it’s easier to find good renters that will keep your property occupied and allow you to maintain a steady rental income.

You don’t need to do all the work yourself. Let the experts handle this tedious process so you can get better profit margins and have more time to do what you love. Secure quality renters now.

Recent Comments