Key takeaways

- Rental properties pose a gold mine of tax deductions that can help property owners maximize income.

- HOA fees, repair and maintenance, and depreciation are just some available related to rental properties.

- Read this list before filing taxes to ensure all your bases are covered.

There are a plethora of ways that property owners can benefit from their rental portfolios, and not just in the form of a monthly rent check. Some of the best aspects of owning investment properties aren’t as obvious until it’s time to file taxes. As a rental property investor, your portfolio is a gold mine of tax deductions that can help boost your profits if you play by the proper rules.

To ensure you get the maximum deduction for your rental property, knowing which deductions apply to your portfolio is crucial. While we can’t list them all in the scope of this article, we can touch on a few critical deductions that might benefit you. Also, we always recommend you speak with your attorney, tax professional or property manager before proceeding.

We’ve included several rental property tax deductions that you should know about, as well as some surprise items you might not be able to deduct that can catch you off guard. As a rental property owner and investor, the right knowledge will help you save on taxes and maximize rental income.

Pesky HOA fees can work for you

Rental property owners with properties under the governance of Homeowner Associations (HOA) have to pay monthly dues. These fees are usually mandatory within a managed community. However, the total amount may vary depending on your location. Additionally, you’ll often have no way of knowing if your payment is put to good use.

As a workaround, since these fees are necessary to the operation of your portfolio, you may treat them as deductibles when tax season comes.

Your bills end up paying you

HOAs are usually in charge of a rental property’s external upkeep. However, the burden of maintenance can fall on you if your rental isn’t located in a managed community or if these tasks don’t fall under the responsibility of your HOA.

Luckily, maintenance costs can be used as deductible expenses. It turns out that giving the front door a fresh coat of paint, cleaning the gutters, or repairing old windows can help you save money. Plus, your renters will appreciate your dedication to keeping their rental homes in the best shape. Routine maintenance is the gift that keeps on giving.

It’s also important to note that not every repair qualifies as a deduction. The following home improvement projects fall outside the Internal Revenue Service’s (IRS) parameters:

- A new roof

- An added room

- Flooring replacements

- New lawns or gardens

These upgrades won’t be considered deduction material by the IRS, which is why it’s always helpful to discuss your tax deductions with a qualified tax professional.

Interest gets interesting

You should remember to take advantage of deducting the mortgage interest on your rental property, which is usually the most significant deductible expense.

While it’s important to keep in mind that there are limits to the amount of interest you can write off based on tax laws signed in 2018, if you agree to depreciate your property over 30 years instead of 27.5, you can avoid this limit altogether.

An appreciation for depreciation

You may not be able to fully deduct the cost of your rental property in the same year that you purchase it, but you can still put the expense of owning a rental to work for you. You can do this by deducting a portion of the property cost over several years, which will reflect the actual purchase price in the long run.

Depreciation is one of your most significant advantages when owning a rental property, especially for a property that continues to gain value every year while falling apart on paper.

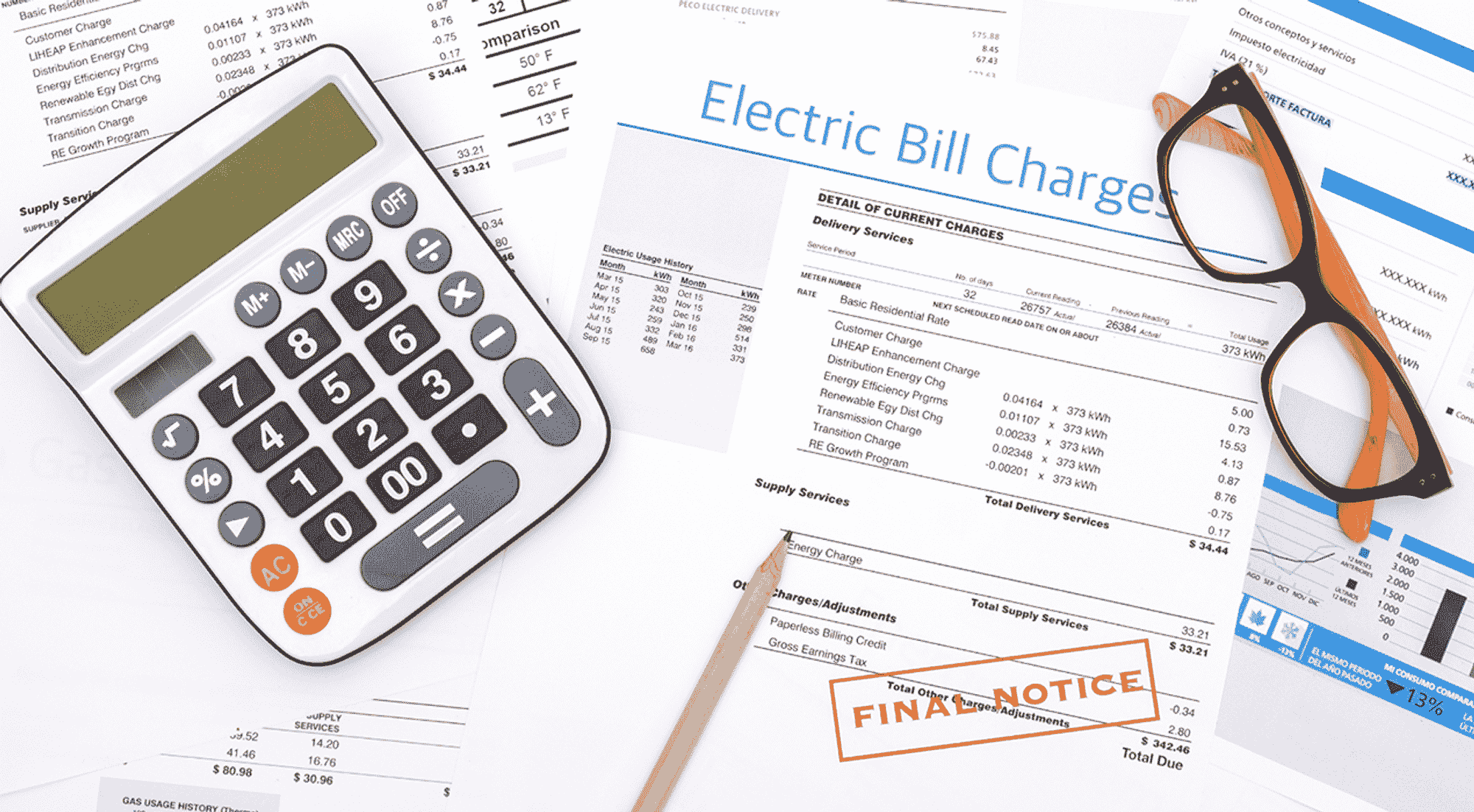

Don’t toss that utility bill

Most lease agreements usually specify that residents will be responsible for paying utility bills during their stay. However, some property owners prefer to pay for these services themselves and roll the estimated costs into the total rent price.

If you’ve been lumping the cost of rent and utilities together, you have the opportunity for a tax deduction. The IRS usually recognizes utilities paid by a property owner as tax deductibles for multi- and single-family properties. Don’t let this deduction slip away when tax season rolls around.

Your property insurance pays off

Your mandatory rental property insurance could mean a big write-off come tax time. The property insurance rate for rental property owners is usually anywhere between 15% and 25%, higher than what a typical homeowner will pay for an owner-occupied property.

This doesn’t mean that all expenses attributed to insurance coverage will be paid back so don’t go all out with too much coverage. The best insurance for your rental properties is the kind that fits your budget and provides ample protection for your investment.

Don’t miss out on these easy tax deductions

One of your annual goals as a property owner should be to make sure that you can capture and maximize tax deductions from your rental business. Doing so greatly benefits your bottom line.

Yet, it’s essential to work on these deductions with a qualified tax professional or advisor. Making the right strategic choices about the taxes concerning your rental income helps you avoid pitfalls with the IRS. More importantly, understanding the tax code or having a professional by your side can be one way to earn back the money you can spend to keep on investing.

Recent Comments